30+ mortgage interest certificate

Web Mortgage credit certificates can increase the federal tax benefits that homeowners can enjoy and make the dream of owning a house more accessible for low- and moderate-income buyers. If the mortgage is ever refinanced the MCC will be voided even if the recipient still owns the home.

Investor Presentation

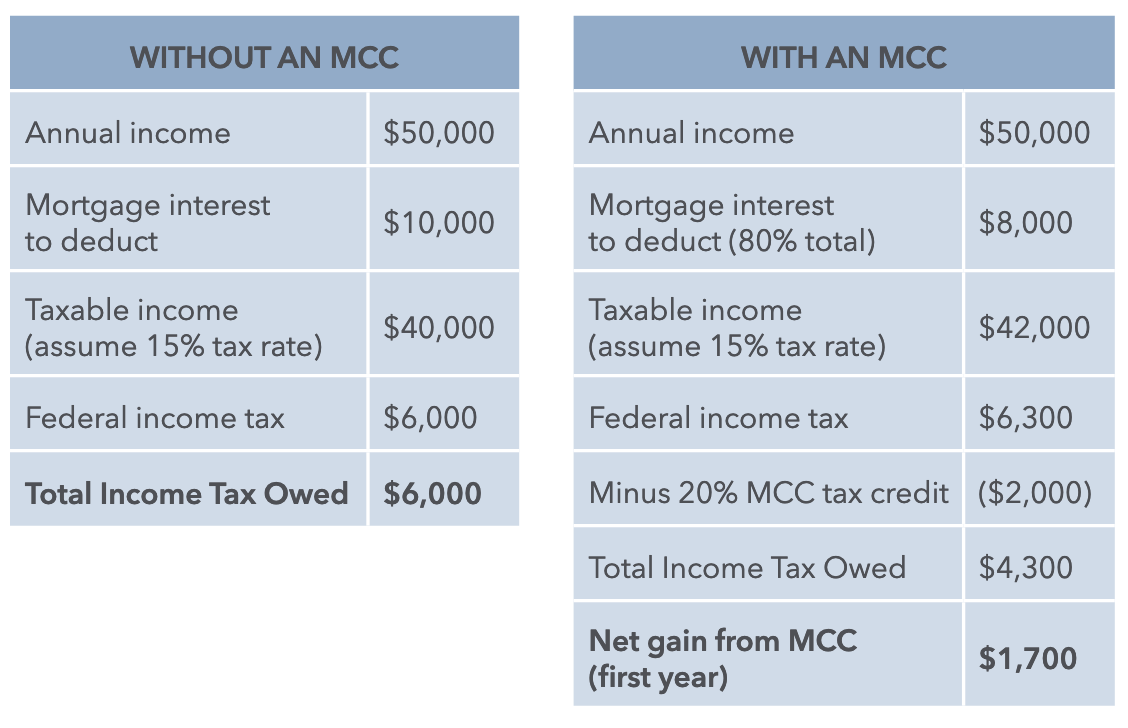

An MCC reduces your federal income taxes every year by allowing you to get 20 of what you spent on mortgage interest back as a tax credit.

. How much you get will depend on factors like the size of your mortgage loan and its interest rate. Web The mortgage credit certificate is a federal home buyer assistance program aimed at helping low-to-moderate income first-time home buyers. Web In the first year he or she would pay approximately 6250 in interest charges and with a mortgage credit certificate could claim a credit of up to 1875 at tax time.

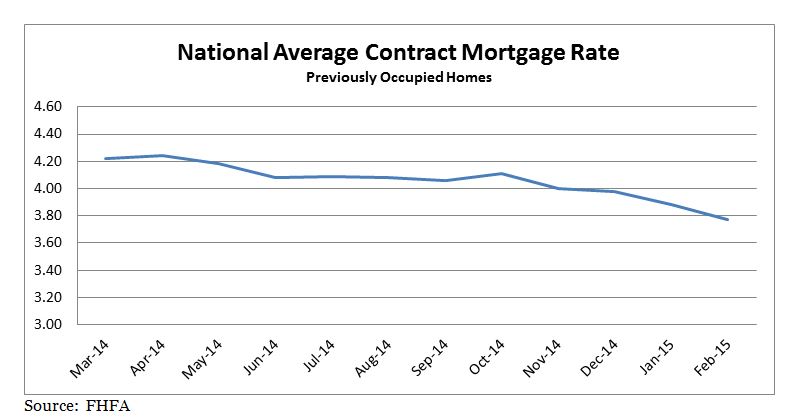

Web A year before the COVID-19 pandemic upended economies across the world the average interest rate for a 30-year fixed-rate mortgage for 2019 was 394. Web Borrowers can get a maximum tax credit of 2000 each year. Web Mortgage Credit Certificate Benefits The tax credit through a MCC is meant to make monthly mortgage payments more affordable for as long as the property remains your primary residence by.

Web The Mortgage Credit Certificate MCC program provides housing assistance by issuing a federal tax credit to first-time homebuyers statewide and repeat homebuyers in targeted areas. 6250 x 30 1875. Mortgage Interest Rates 30 Mar 2023.

Web The purpose of the mortgage is to help low-income taxpayers pay for their housing. This form can only be used to order certificates of interest for mortgage accounts with account numbers which are five digits then a letter then another five digits for example 12350A-12345. A basis point is equivalent to 001 Thirty-year fixed.

You can only apply for a credit if you receive a mortgage certificate MCC from a local or state government agency. This as the average contract interest rate for 30-year fixed-rate mortgages with conforming loan. The maximum tax credit you can get is 2000.

Web If youre in the market for a mortgage refinance todays current average interest rate for a 30-year fixed refinance is 719 up 16 basis points over the last seven days. Web Mortgage credit certificates MCCs help first-time homebuyers and other qualified homeowners afford their mortgages by allowing them to claim a credit on their federal tax return the mortgage interest credit worth a portion of the mortgage interest they paid up to a maximum of 2000. The exact amount of the tax credit a borrower will receive is calculated through a formula that takes into account the mortgage amount.

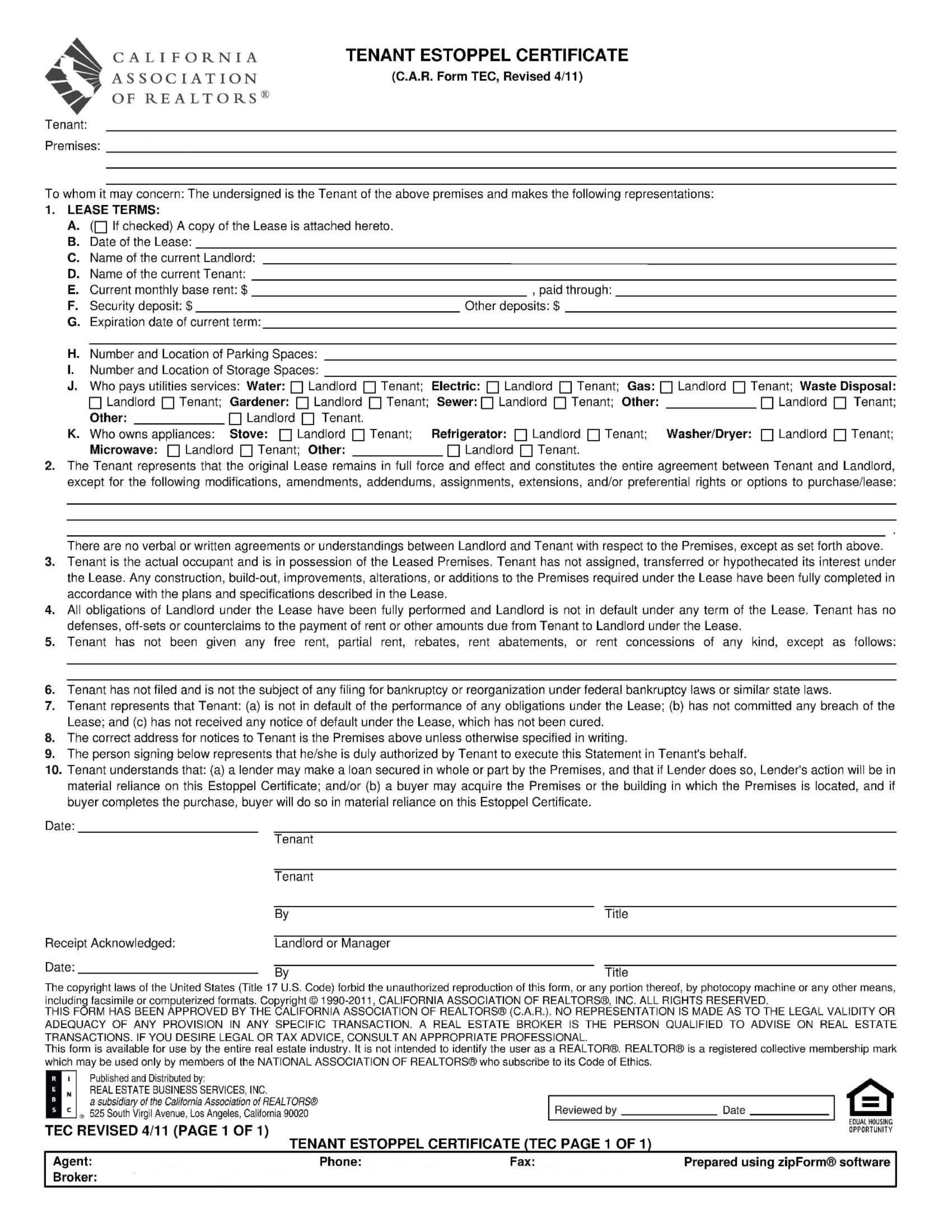

Web You may be able to claim a mortgage interest credit if you were issued a mortgage credit certificate MCC by a state or local government. Form 8396 allows homeowners to apply for mortgage interest credit but only those who receive a mortgage certificate from a local or state. Web The certificate will be posted to the address held on file for the account holder.

Figure the credit on Form 8396 Mortgage Interest Credit. Web Use Form 1098 Info Copy Only to report mortgage interest of 600 or more received by you during the year in the course of your trade or business from an individual including a sole proprietor. About Form 1098 Mortgage Interest Statement Internal Revenue Service.

Qualified homebuyers can credit 20 of their annual mortgage interest paid against their year-end tax liability. Web Mortgage credit certificates offer a dollar-for-dollar tax credit on mortgage interest. Web The remaining 80 interest is still eligible as a tax deduction.

The average rate for 2021 was 296 the. An MCC usually costs around 650 up front and mortgage lenders may charge an additional 100 processing fee at their discretion. Web The average interest rate for a standard 30-year fixed mortgage is 712 which is a growth of 18 basis points from one week ago.

Once approved youll receive the mortgage credit every year for the life of your loan as long as it is your primary. When you receive an MCC you can claim a deduction of up to 2000 on the mortgage interest you paid on your home. Web An MCC is a federal tax credit given by the IRS to low-income borrowers and its typically reserved for first-time home buyers.

Web If you are a first-time home buyer see definition here you can apply for a mortgage interest tax credit known as a Mortgage Credit Certificate MCC. The maximum amount of tax credit you can receive each year is 2000. Interest rates mortgage 30 years mortgage interest rates 30 yr 30 fixed rate mortgage current 30 mortgage interest rate 30 day mortgage interest rates todays mortgage.

Web A mortgage credit certificate is a federal tax credit for homeowners that can help them save on their yearly tax bills. Web Mortgage Interest Rates 30 - If you are looking for a way to reduce your expenses then our trusted service is just right for you. The amount you could save on your taxes with an MCC varies by state but.

If you take this credit you must reduce your mortgage interest deduction by the amount of the credit. First-time low-income home buyers are eligible for this program. If youd like to order for an account with eight digits please get in.

Web Mortgage demand dropped for the third straight week as interest rates moved higher again.

What Is A Mortgage Credit Certificate And How Does It Work

Public Affairs Detail Federal Housing Finance Agency

:max_bytes(150000):strip_icc()/GettyImages-472566664-c8b2a74ab9cb482d89f6623cdeaa51ac.jpg)

Profit From Mortgage Debt With Mbs

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

Giwuxc7bgszzm

Excel Mortgage Calculator How To Calculate Loan Payments In Excel

41 Real Estoppel Certificate Forms Samples ᐅ Templatelab

Apr Vs Interest Rate On A Va Loan

What Is A Mortgage Credit Certificate Mcc Smartasset

Current Va Mortgage Rates March 2023

Glossary Of Banking Terms And Phrases

What Is A Mortgage Credit Certificate First Time Buyers

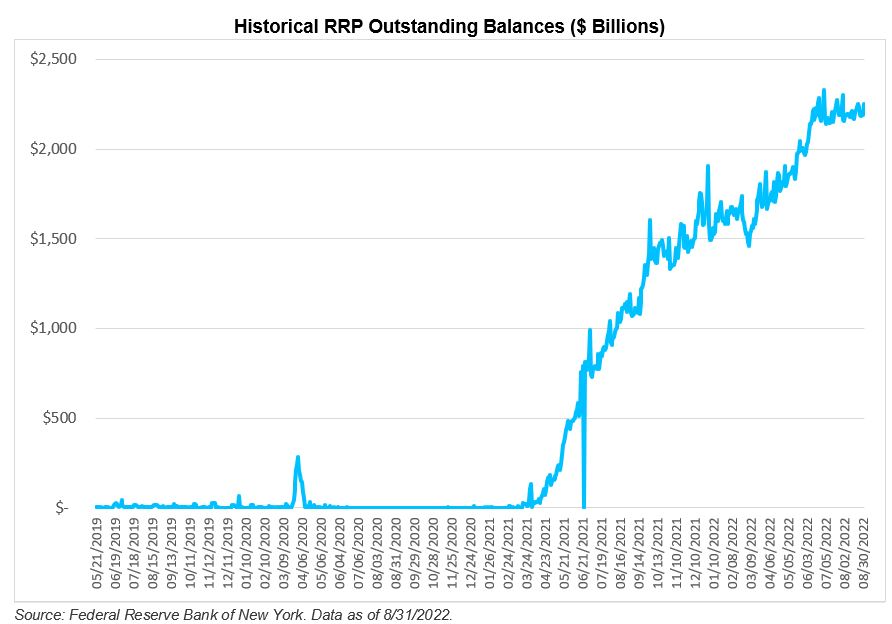

Checking The Pulse Silicon Valley Bank

![]()

Today S Va Mortgage Rates March 2023 Purchase Refi

Personal Loan Apply Instant Loan Online 10 49

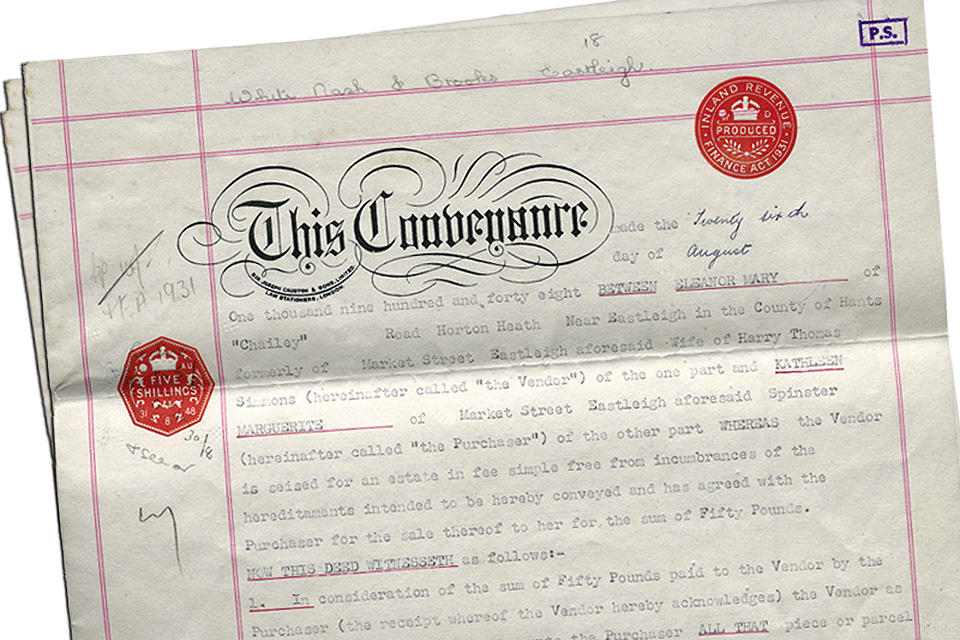

Where Are My Title Deeds And Do I Need Them Hm Land Registry

Full 30 Year Title Search Vs O E Report What S The Difference Propertyonion